Banking reform bill lacks digital age safeguards; need deeper scrutiny: Opposition

The Hindu

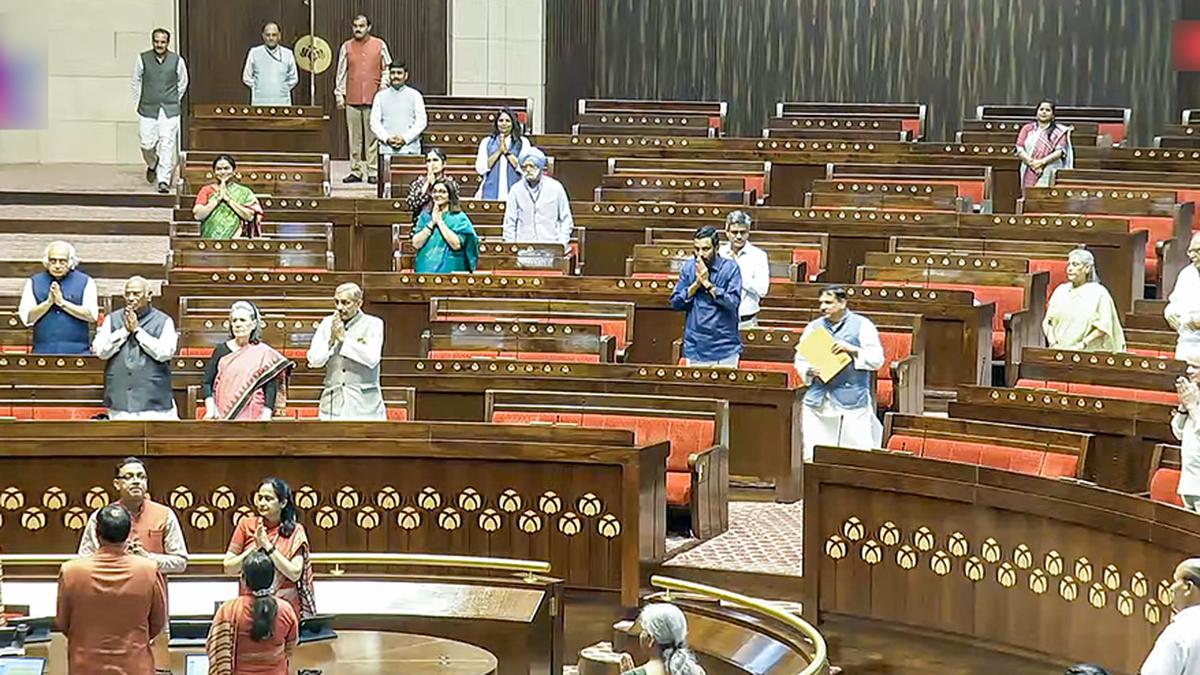

Parliamentarians debate proposed amendments to banking laws, highlighting concerns over transparency, governance, and technological challenges in the sector.

Opposition members in Rajya Sabha on Wednesday (March 26, 2025) raised concerns over the Banking Laws (Amendment) Bill, 2024, saying that the proposed legislation fails to keep pace with the rapidly evolving financial landscape.

Parliament Budget Session Day 11 LIVE

Participating in a discussion on the bill, Harish Beeren (IUML) said the Upper House must ponder over amendments to the five banking laws that are brought at "single stroke".

"Certain provisions warrant deeper scrutiny and potential revision." While acknowledging the intent of the bill, Fauzia Khan (NCP-SCP) raised several concerns about the proposed legislation's narrow scope.

Also Read | Congress MPs meet Speaker, raise issue of denial of opportunity to Rahul Gandhi in Lok Sabha

She called for a dynamic approach to the Rs 2 crore threshold for substantial interest, suggesting it should be indexed to inflation and economic conditions.

Ms. Khan pointed out that the bill overlooks crucial challenges facing rural and cooperative banks, including high non-performing assets (NPAs) and technological infrastructure limitations.

Run 3 Space | Play Space Running Game

Run 3 Space | Play Space Running Game Traffic Jam 3D | Online Racing Game

Traffic Jam 3D | Online Racing Game Duck Hunt | Play Old Classic Game

Duck Hunt | Play Old Classic Game