Tiruchi Corporation steps up efforts to ramp up revenue mobilisation

The Hindu

Tiruchi City Corporation has intensified its efforts to mop up property tax collection and other charges as the financial year draws to a close

Tiruchi City Corporation has intensified its efforts to mop up property tax collection and other charges as the financial year draws to a close.

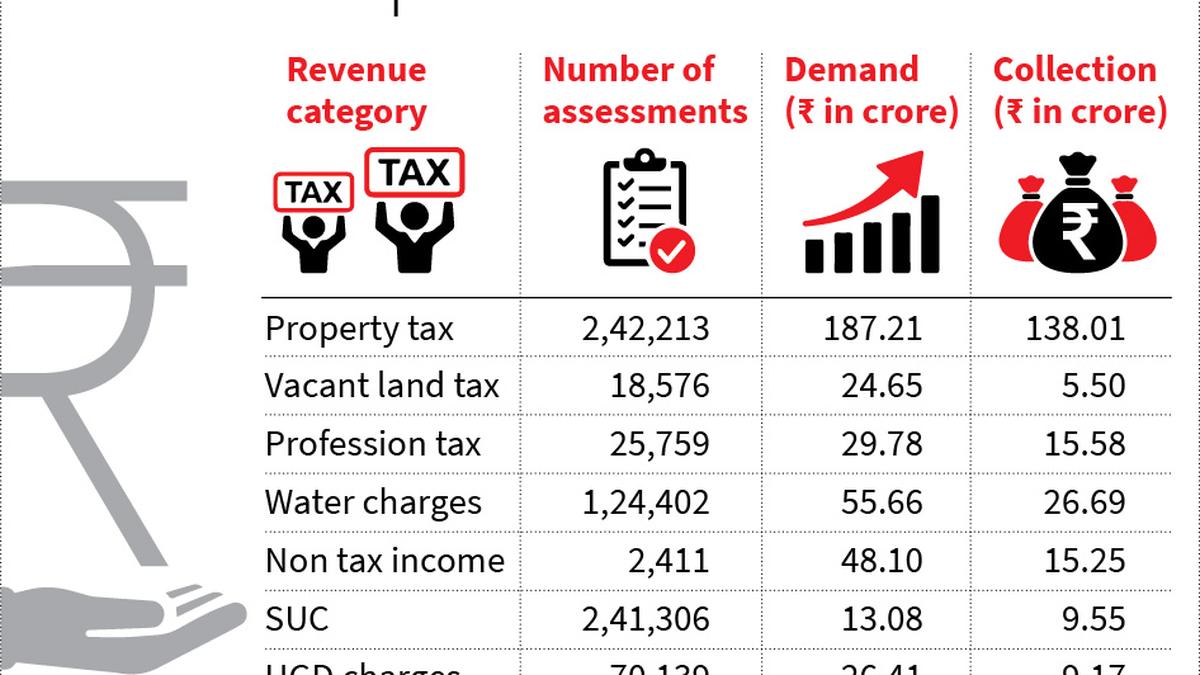

The Corporation, according to data furnished by it, has so far collected about 74.43% of the tax demands this financial year. Of the estimated tax revenue of ₹384.92 crore, including arrears, the civic body has collected about ₹219.77 crore as on March 19. The outstanding arrears stand at ₹153 crore, of which ₹47.15 crore has been collected, which is around 30.82%.

Nearly 49% of the tax revenue comes from property tax. Of the total demand of ₹187.21 crore in property tax, it has collected ₹138.01 crore, which is around 73.72% of it. The collection of solid waste management user charges (SUC) stands at ₹9.55 crore against the annual projection of ₹13.08 crore, achieving 73.07% of the total demand.

In the non-tax revenue category, the civic body has collected ₹15.25 crore as rent from its properties against the total demand of ₹48.10 crore.

The total tax revenue, including property tax, profession tax, and SUC has surpassed 50%. However, vacant land tax, water charges, non-tax revenue, and underground drainage (UGD) charges remain low, prompting further action in these areas. “Collection of profession tax and non-tax revenue will pick up by the end of this month. Necessary steps will be taken to push the overall tax collection,” said V. Saravanan, Corporation Commissioner.

The civic body has set a target of 85% of property tax collection by March. An intensive drive has been undertaken to collect the balance before the end of the fiscal. Notices are being issued to property owners who have failed to pay the tax in time. A crackdown has been initiated on top defaulters. Recently, officials severed the UGD connection of commercial property for long-overdue taxes in Ward 14.

The tax collection centres have been functioning on all working days from 9 a.m. to 6 p.m. Online tax payment system, enabling citizens to pay taxes through unified payments interface (UPI) applications, has been made available for a hassle-free experience.

On getting information that the promoters of Srinivas College had encroached on parts of 4.11 poramboke (community) land of Nandini river for construction of a building, an official team visited the site on March 6. The Dishank software revealed that the college had encroached on 23 cents of poramboke land in Survey No. 47/1A1, and filled it with soil. A detailed mahzar (examination) was done on March 10 and a police complaint was lodged on March 17.

Over the past five years, a mere 1,525 driving licences were cancelled across India for traffic violations. Tamil Nadu accounted for half of these cancellations, while Delhi and West Bengal reported just three each. Haryana recorded four cancellations, while Assam, Bihar, Kerala, Uttar Pradesh, and Rajasthan recorded 104, 158, 119, 105, and 94 cancellations, respectively. Maharashtra, a State with a high volume of traffic violations, recorded only 15 cancellations.