Harish Rao rebuts Kishan Reddy’s claims on devolution of Central funds to TS

The Hindu

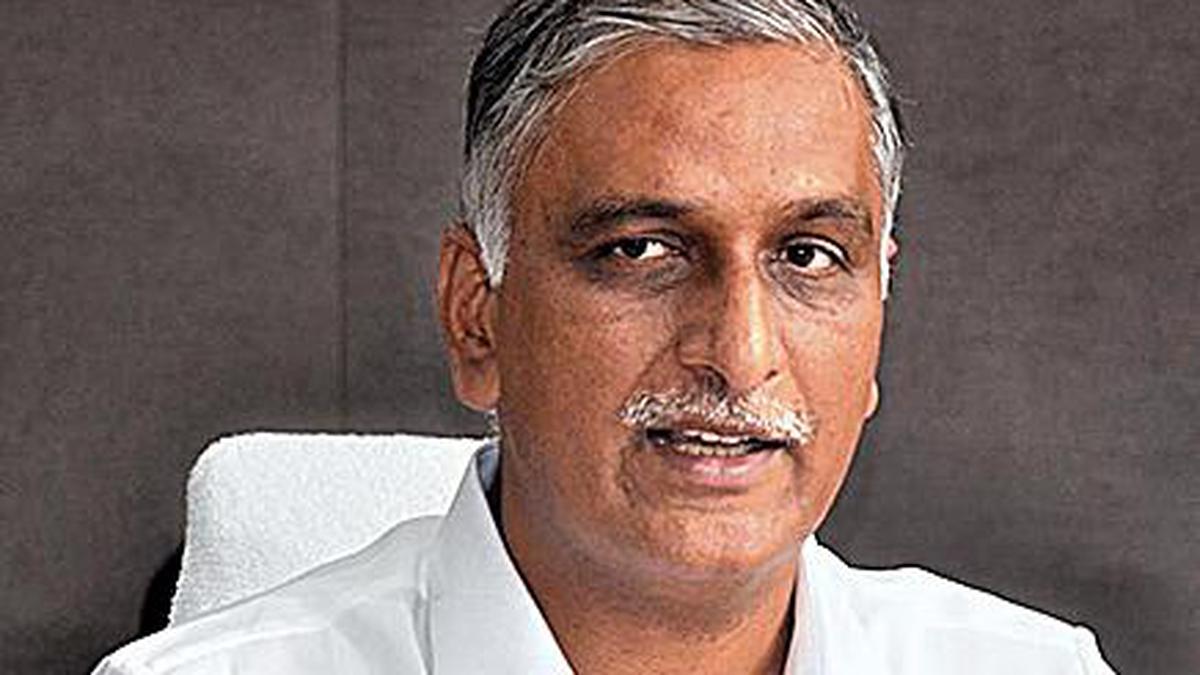

Telangana Minister for Finance and Health T. Harish Rao asks why Centre is withholding ₹1.43 lakh crore due to Telangana

Telangana Minister for Finance and Health T. Harish Rao has remarked that the claims made in a powerpoint presentation by Union Minister G. Kishan Reddy on the devolution of funds from the Centres to Telangana were baseless and filled with falsehood.

In a rebuttal to the Union Minister’s claims made on Saturday, Mr. Harish Rao said the former had displayed his frustration by resorting to blatant lies by claiming even the loans borrowed by the State government and the loans given to individuals in the Centre’s devolution account.

“One of his claims revolves around personal loans sanctioned by banks. The Central government, represented by Mr. Kishan Reddy, should be ashamed of taking credit for loans extended to individuals”, the Minister said. He reiterated that devolution of tax share was the Constitutional right of States and it was not a part of the Consolidated Fund of India.

Despite the 15th Finance Commission’s recommendation for the devolution of 41% share of Central taxes to States, the States were getting only about 30% due to the inclusion of various cess and surcharges, which would not contribute to the shared tax pool. Telangana’s share in tax devolution from the Centre had decreased from 2.893% in 2014-15 to 2.102% in 2021-22, he disclosed.

Further, Mr. Kishan Reddy had falsely claimed that 100% of houses in Telangana had access to tap water with the Centre’s contribution of ₹1,588.08 crore for Mission Bhagiratha. The reality, however, was that the amount provided by the Centre was not even sufficient for the yearly maintenance of the project. The State government had implemented it at a cost of ₹36,000 crore mobilised on its own, he claimed.

Mr. Kishan Reddy also highlighted the “special treatment” to Telangana provided by the Reserve Bank of India (RBI) through the Ways and Means facility. However, the facility was aimed to assist States in balancing revenue and expenditure and it was available to all States and not just Telangana. As with any other State, Telangana was being charged 6% interest rate on those advances.

On GST compensation cess, Mr. Harish Rao said ₹34,737 crore was collected in Telangana between 2017-18 and 2022-23. However, only ₹8,927 crore compensation was paid to Telangana against the GST cess of ₹10,285 crore collected from it in the first two years of GST implementation. He made it clear that compensation funds would not come from the Consolidated Fund of India but from the GST Compensation Fund.