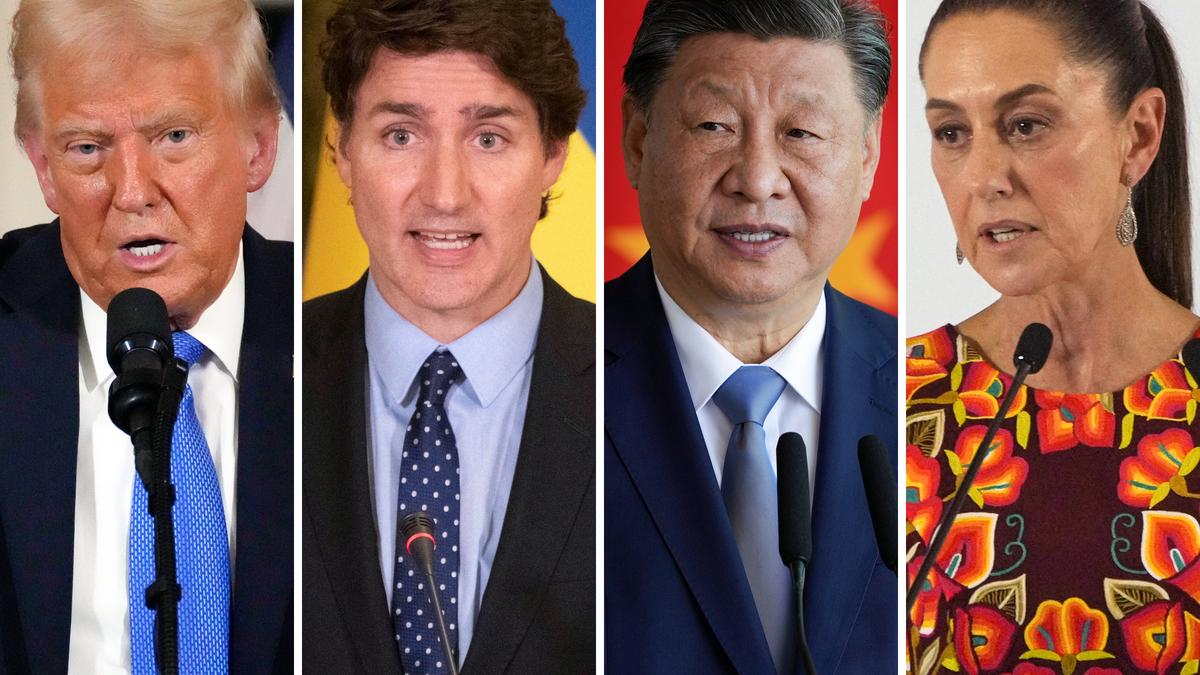

World shares decline as Trump’s tariffs on Canada, Mexico and China take effect

The Hindu

China retaliates with higher tariffs on U.S. farm exports, global markets drop, and investors brace for trade war impact.

European and Asian shares were mostly lower Tuesday (March 4, 2025) after a new round of tariffs imposed by U.S. President Donald Trump took effect.

China hit back at Washington's move to raise tariffs by 20% across the board with higher duties of up to 15% on U.S. farm exports.

Germany's DAX slipped 1.8% to 22,733.26 while in Paris the CAC 40 declined 1.1% to 8,108.71. Britain's FTSE 100 lost 0.4% to 8,837.92.

The future for the S&P 500 rose 0.1% while that for the Dow Jones Industrial Average was unchanged.

In Asian trading, Tokyo's Nikkei 225 dropped 1.2% to 37,331.18, while the Hang Seng in Hong Kong lost 0.4% to 22,922.16. The Shanghai Composite index edged 0.2% higher to 3,324.21.

South Korea's Kospi gave up 0.2% to 2,528.92. Taiwan's Taiex shed 0.7%, while Bangkok's SET lost 1.1%.

On Monday, the S&P 500 dropped 1.8% after Trump said there was “no room left” for negotiations that could lower the tariffs that took effect Tuesday for imports from Canada and Mexico. Trump had already delayed the tariffs once before to allow more time for talks.