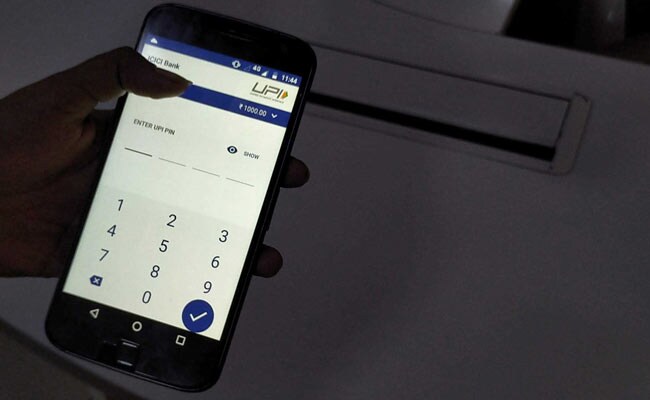

UPI Merchant Transactions Over Rs 2,000 To Carry Charge Of 1.1% From April 1

NDTV

The National Payments Corporation of India (NPCI) said that using Prepaid Payment Instruments (PPIs) for transactions through UPI will attract an interchange fee. The charges will be levied if the transaction is more than Rs 2,000.

The National Payments Corporation of India (NPCI) has notified that an interchange fee of up to 1.1 per cent will be applicable on merchant UPI (Unified Payments Interface) transactions from April 1.

In a recent circular, the NPCI said that using Prepaid Payment Instruments (PPIs) for transactions through UPI will attract an interchange fee. The charges will be levied if the transaction is more than Rs 2,000.

The interchange fee varies for the different categories of merchants. It ranges from 0.5% to 1.1% and a cap is also applicable in certain categories.

For telecom, education, and utilities/post office, the interchange fee is 0.7% while for supermarkets the fee is 0.9% of the transaction value. 1% charges will be levied for insurance, government, mutual funds, and railways, 0.5% for fuel, and 0.7 for agriculture, reported CNBC TV-18.

Run 3 Space | Play Space Running Game

Run 3 Space | Play Space Running Game Traffic Jam 3D | Online Racing Game

Traffic Jam 3D | Online Racing Game Duck Hunt | Play Old Classic Game

Duck Hunt | Play Old Classic Game