Trump wants to close the carried interest tax loophole, a longtime target of Democrats

CBSN

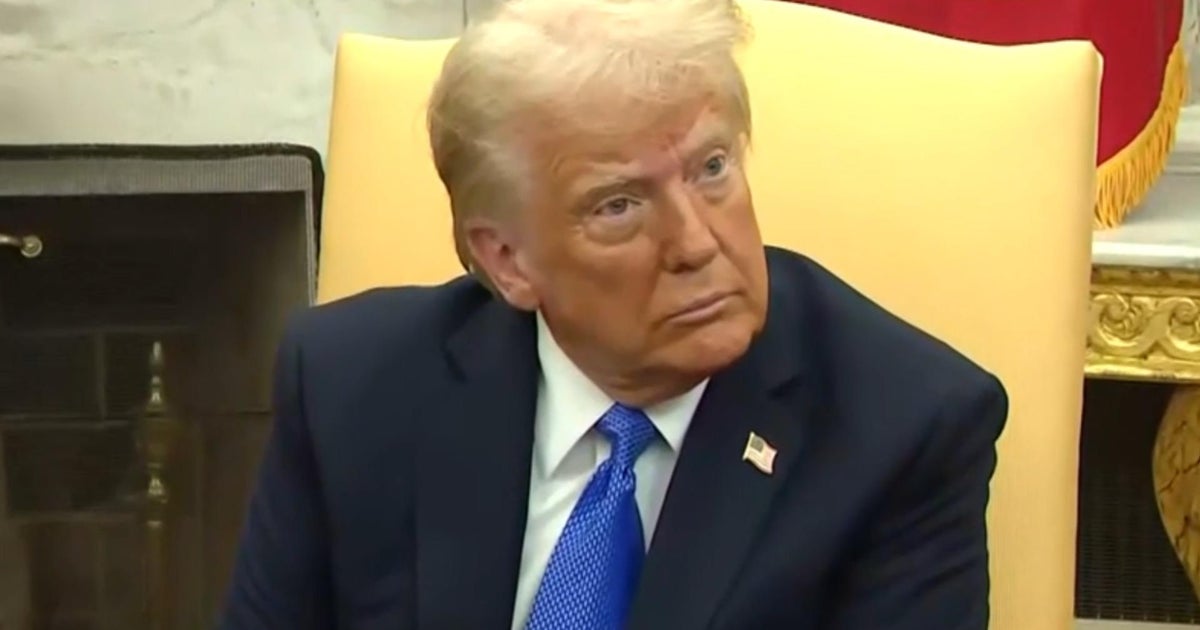

President Trump is proposing to eliminate a tax loophole that's also a long-time target of some Democratic lawmakers.

Mr. Trump is working on "no tax on seniors' Social Security, no tax on overtime pay" as well as renewing the tax cuts in the 2017 Tax Cuts and Jobs Act, White House press secretary Karoline Leavitt said on Jan. 6. But, she added, the president also wants to abolish the "carried interest tax deduction loophole."

The latter tax break might not be well-known to many Americans given that it's predominantly used by hedge funds, private equity firms and other types of investment funds. That loophole allows investment managers to greatly lower their taxable income, a major perk for investors whose annual earnings can mount into the billions.

An Immigration and Customs Enforcement officer provided new details about the Trump administration's deportation flights of alleged gang members, but continued to argue the government had a right to reject a judge's order directing the planes to return to the U.S., even if they were already in the air.