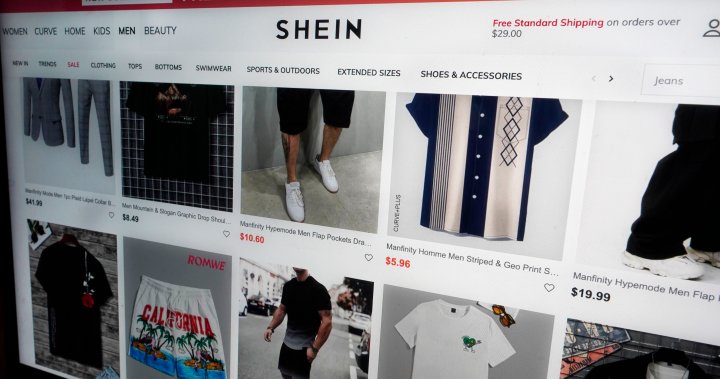

Shein, controversial fashion retailer, reportedly files for U.S. IPO

Global News

China-founded fast fashion retailer Shein is gearing up for an initial public offering in the United States, according to reports from Reuters and the Wall Street Journal.

Fashion company Shein has confidentially filed to go public in the United States, according to two sources familiar with the matter, in what is likely to be one of the most valuable China-founded companies to list in New York.

Goldman Sachs, JPMorgan Chase and Morgan Stanley have been hired as lead underwriters on the initial public offering (IPO), and Singapore-based Shein could launch its new share sale some time in 2024, the sources said.

Shein has not determined the size of the deal or the valuation at IPO, the sources said. Bloomberg reported earlier this month it targeted up to $90 billion in the float.

Global News reached out to Shein to confirm the news, but a spokesperson for the retailer declined to comment. Reuters also said the banks and Shein declined comment.

Shein’s confidential U.S. IPO filing was first reported by China’s Shanghai Securities Journal last week. The Wall Street Journal earlier on Monday confirmed the report citing sources.

The company founded in mainland China in 2012 was valued at more than $60 billion in a May fundraising, down by a third from a funding round last year.

The most valuable China-founded enterprise to go public in the United States so far is ride-hailing giant Didi Global’s 92Sy.MU debut in 2021 at $68 billion valuation.

The fast-fashion giant’s move to go public in the U.S. comes as the market for initial public offerings is struggling to rebound after a string of lackluster stock market debuts.