RBI to enable UPI for cash deposit facility, to allow foreign investors in IFSC to invest in Sovereign Green Bonds

The Hindu

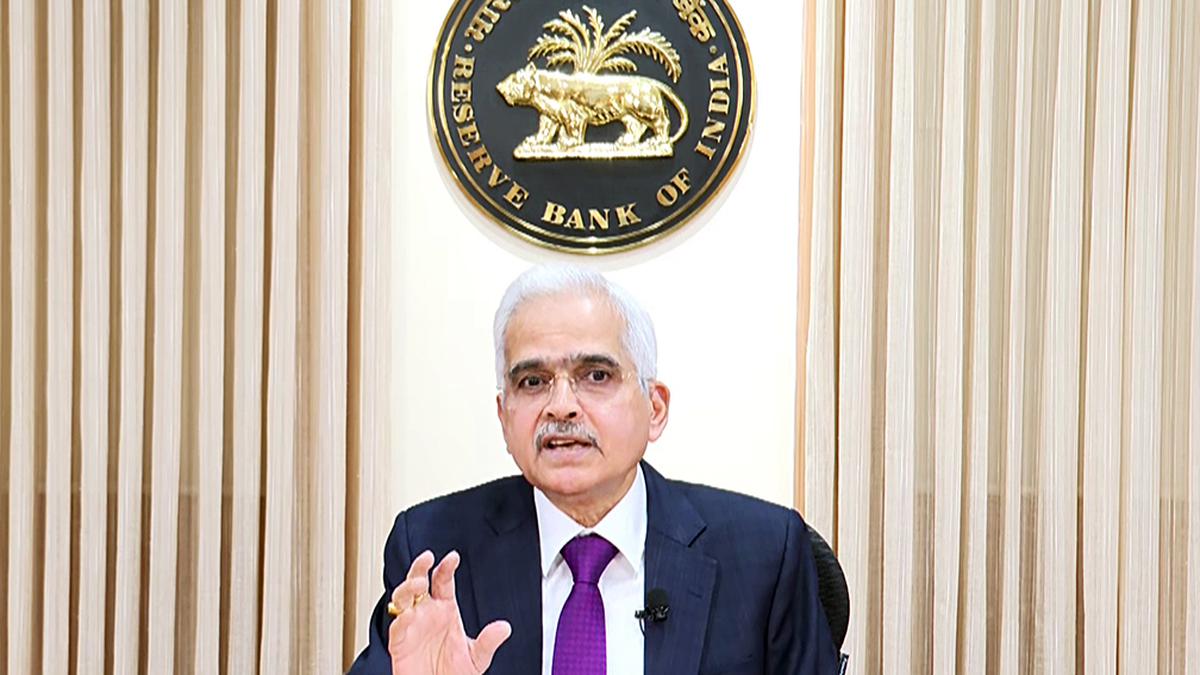

Considering the popularity and convenience of UPI, the Reserve Bank of India (RBI) has proposed to enable UPI for cash deposit facility. RBI Governor Shaktikanta Das, while making a statement on developmental and regulatory policies, said, “Given the popularity and acceptance of UPI, as also the benefits seen from the availability of UPI for card-less cash withdrawal at ATMs, it is now proposed to facilitate cash deposit facility through use of UPI.”

Considering the popularity and convenience of UPI, the Reserve Bank of India (RBI) has proposed to enable UPI for cash deposit facility. RBI Governor Shaktikanta Das, while making a statement on developmental and regulatory policies, said, “Given the popularity and acceptance of UPI, as also the benefits seen from the availability of UPI for card-less cash withdrawal at ATMs, it is now proposed to facilitate cash deposit facility through use of UPI.”

Cash Deposit Machines (CDMs) deployed by banks enhance customer convenience while reducing cash-handling load on bank branches. The facility of cash deposit is presently available only through the use of debit cards.

The Governor said operational instructions on enabling UPI for cash deposit facility will be issued shortly.

In another announcement to provide more flexibility to Prepaid Payment Instruments (PPIs) holders, the RBI has proposed to permit linking of PPIs through third-party UPI applications. “This will enable the PPI holders to make UPI payments like bank account holders. Instructions in this regard will be issued shortly,” Mr. Das said.

At present, UPI payments from bank accounts can be made by linking a bank account through the UPI App of the bank or using any third-party UPI application. However, the same facility is not available for PPIs. PPIs can currently be used to make UPI transactions only by using the application provided by the PPI issuer.

Meanwhile in another measure, the RBI to facilitating wider non-resident participation in Sovereign Green Bonds (SGrBs), decided to permit eligible foreign investors in the International Financial Services Centre (IFSC) to also invest in such bonds.

A scheme for investment and trading in SGrBs by eligible foreign investors in IFSC is being notified separately in consultation with the Government and the IFSC Authority.