RBI monetary policy update: repo rate unchanged, retains FY24 GDP growth forecast at 6.5%

The Hindu

The Reserve Bank on June 8 decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50% and retained the GDP growth projection for current fiscal year at 6.5%, on the back of supportive domestic demand conditions.

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), on the basis of an assessment of the current and evolving macroeconomic situation, on June 8 decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50%

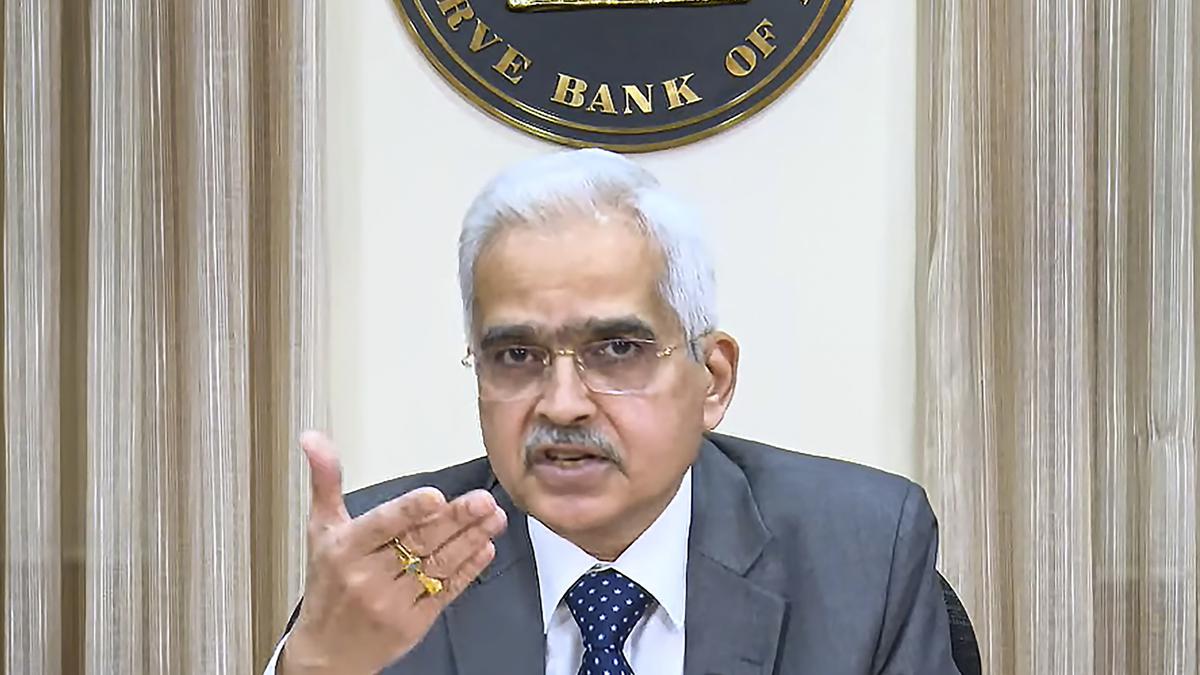

The standing deposit facility (SDF) rate remains unchanged at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%, RBI Governor Shaktikanta Das said.

This is the second time that the policy rate has been paused after a 250 basis point conservative rate hike to curb inflation.

Editorial | Optical relief: On headline inflation

The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth, he said.

“These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth,” he added.

On the outlook, Mr. Das said going forward, the headline inflation trajectory was likely to be shaped by food price dynamics. Wheat prices could see some correction on robust mandi arrivals and procurement.