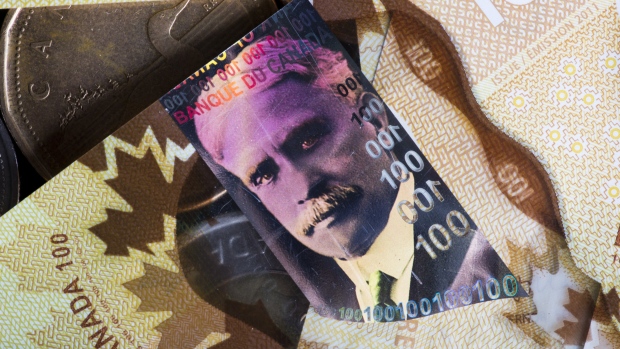

One-in-four Canadians taking on debt to afford higher costs: report

BNN Bloomberg

Canadians feeling the pressure from rising inflation are taking on additional debt, with one in four stating they’ve had to do this in order to afford higher living costs, according to a report by Finder.

In a survey of 1,013 Canadian consumers, 36 per cent said their top reason to take out a loan this year is to cover bills like mortgage and food. The second biggest reason for a loan was to consolidate existing debt (24 per cent), then to cover bills and living expenses due to job loss (19 per cent.)

“Data shows that wages are not keeping pace with higher living costs and this puts middle-income earners—the bulk of Canadians—in a tough position,” said Romana King, senior finance editor at Finder, in the report.

“It forces many to start prioritizing their expenses and finding ways to make ends meet.”

Run 3 Space | Play Space Running Game

Run 3 Space | Play Space Running Game Traffic Jam 3D | Online Racing Game

Traffic Jam 3D | Online Racing Game Duck Hunt | Play Old Classic Game

Duck Hunt | Play Old Classic Game