Man alleged to be behind high-interest mortgage scam living large on social media

CBC

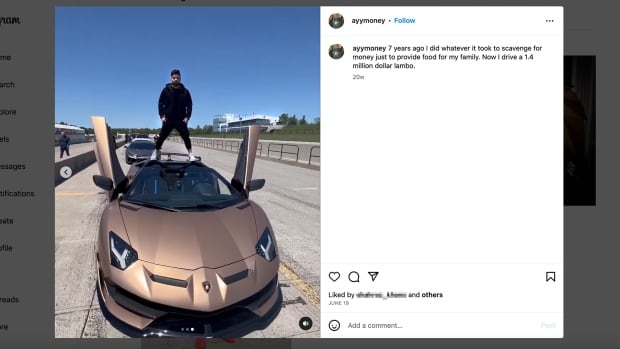

In his social media videos, Anas Ayyoub has painted a rags-to-riches story in which he says he went from having to "scavenge" for money to provide food for his family to a lifestyle that now allows him to drive a Lamborghini he says is worth $1.4 million.

But offline, a number of Canadians — mostly seniors — accuse Ayyoub of defrauding them, allowing him to enjoy that luxurious way of life.

They allege he is part of a scheme involving door-to-door equipment rental contracts, questionable renovations and high-interest mortgages worth hundreds of thousands of dollars that many homeowners didn't know they had and can't afford.

CBC's Marketplace reported on the scheme back in March, and since then, the Ontario Provincial Police (OPP) executed a search warrant at Ayyoub's home in Mississauga, which included seizing that Lamborghini earlier this year. Ayyoub hasn't been charged.

Lawyer Greg Weedon represents many of the alleged victims and says that as far he knows, despite the search warrant, Ayyoub is no longer in Canada.

"The fact that he was able to get out of the country with all these victims' … funds, at the end of the day, it is just a complete failure," said Weedon.

In a statement provided to Marketplace through his lawyer, Ayyoub notes that he continues to be a Canadian resident. He says he has "always conducted his business dealings lawfully and in accordance with the advice and guidance of senior counsel and consultants."

Ayyoub's social media pages have been private following Marketplace's outreach to him.

In a statement to Marketplace, an OPP spokesperson said due to the ongoing criminal investigation, the Serious Fraud Office cannot provide specific details regarding this case. They added they are working with victims to ensure their needs and rights are a priority and that "enhancing awareness and education on this fraud is paramount to prevent or limit further victimization".

Since Marketplace's investigation aired, professional discipline has been initiated against two lawyers and a mortgage brokerage connected to some of the cases.

WATCH | Marketplace's March 2023 investigation into mortgage fraud:

But in the meantime, several homeowners could face foreclosure, including Sherri Clarke, who says she only realized she had been scammed after watching Marketplace's investigation last March and thinking that "sounds a lot like what just happened to me."

Each situation is unique, but many seem to follow a pattern where homeowners — usually seniors — who have previously been duped into various door-to-door HVAC equipment rental contracts are again approached at home by people who say they can help the homeowner consolidate their debt.

In some cases, the homeowners are told they are eligible to receive money back if they buy more equipment or have renovations done on their homes. In reality, their home is used as collateral and they are allegedly tricked into signing mortgage papers that many say they did not want, or understand.