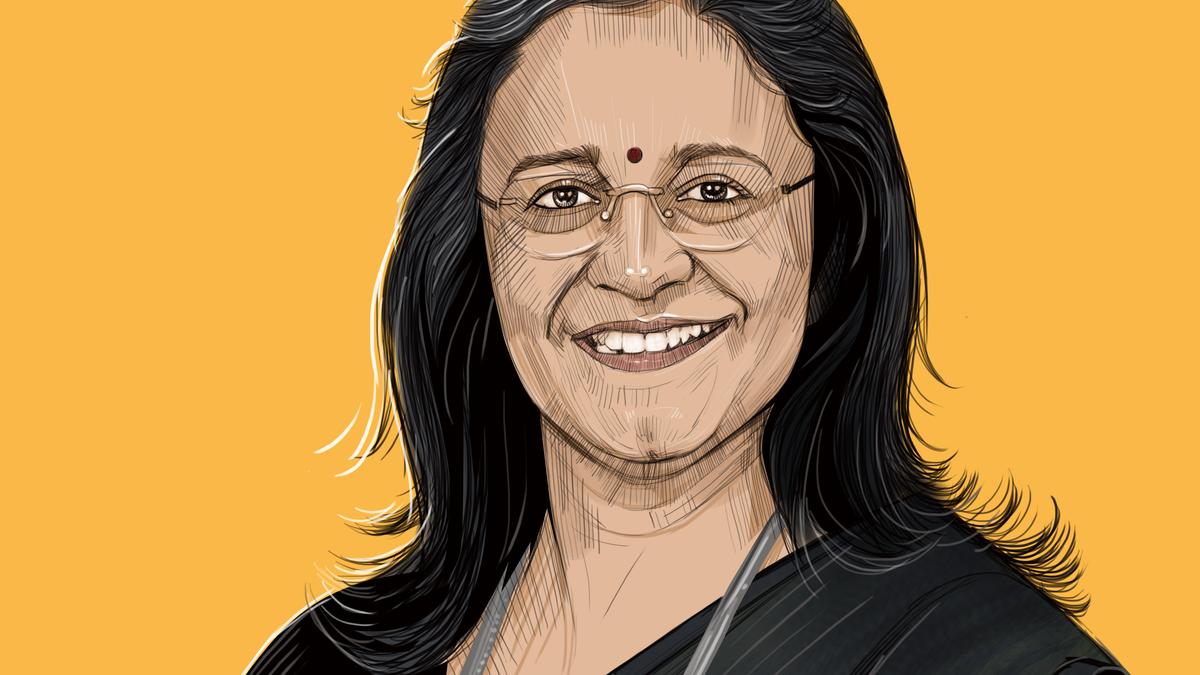

Madhabi Puri Buch | The regulator at the centre of a storm Premium

The Hindu

The SEBI chief has been facing a barrage of allegations following U.S. short-seller Hindenburg Research’s August 10 statement asserting improprieties tied to the Adani Group that forced her and her husband to state that their lives and finances were an ‘open book’.

The Securities and Exchange Board of India (SEBI) is the apex regulator for the securities market with a preamble that affirms its commitment “to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.”

In February 2022, the Government announced the appointment of Madhabi Puri Buch, who was at the time a Whole Time Member on the SEBI board, as the first woman to head the securities markets regulator.

An Indian Institute of Management, Ahmedabad alumna with a graduate degree in Mathematics from St. Stephen’s College, New Delhi, Ms. Buch is also one of the youngest chiefs at SEBI, taking the helm from her predecessor in March 2022, when she was about 56.

A veteran of the investment banking and financial services industry, who at one-time headed ICICI Securities as its MD &CEO, Ms. Buch was expected to bring vital industry perspective to her job of regulating the markets and securities issuances while ensuring that investor protection was always accorded the highest priority.

A protege of N. Vaghul and subsequently K.V. Kamath during her years at ICICI, Ms. Buch even had a stint as a consultant to the Shanghai-based BRICS-established New Development Bank, which Mr. Kamath led for a while.

Less than a year into her job at SEBI’s helm, Ms. Buch faced her first stern test of regulatory stewardship when, in January 2023, U.S. short-seller Hindenburg Research levelled exhaustive charges of stock price manipulation and accounting fraud against the Adani Group of companies.

With the prices of all the listed Adani Group entities nosediving in the wake of the Hindenburg allegations, hundreds of crores of investor wealth was wiped out in just a matter of a few trading sessions, sparking a series of petitions in the country’s top court seeking judicial intervention.