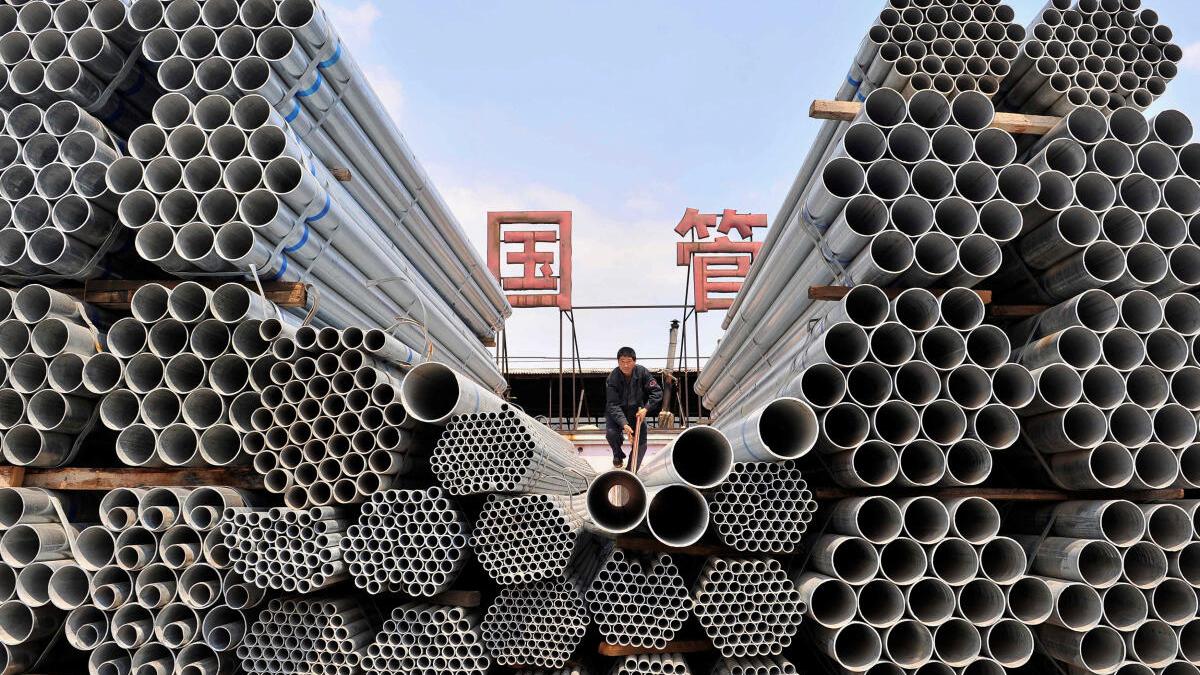

India to reject call for anti-subsidy tax on certain Chinese steel products

The Hindu

India to reject recommendation to impose CVD on Chinese steel products, protecting steel consuming firms from higher prices. Decision aims to balance interests of users and manufacturers, while helping Chinese shipments due to weak demand at home.

India will not impose countervailing duty (CVD) on select steel products imported from China despite a recommendation from trade officials and lobbying from local steel manufacturers, a government source told Reuters.

In a rare move, the Ministry is to reject the recommendation by the Directorate General of Trade Remedies (DGTR) to impose 18.95% CVD on certain flat-rolled steel products imported from China for five years, the finance ministry official directly involved in the matter, told Reuters.

The decision by the Finance Ministry aims to protect steel consuming firms from higher prices even though it could hurt local steel manufacturers, the source said.

"Imposing CVD protects manufacturers, but users end up paying a higher cost," said the official, who did not want to be named because a final decision has not been made public. "So you have to balance the interest between users and manufacturers."

CVDs are additional taxes imposed on imported goods or products that are subsidised in their home country thus hurting the industries in the country importing them.

As per World Trade Organisation rules, a member country is allowed to impose an anti-subsidy duty if a product is subsidised by the government of its trading partner.

CVD by India on such Chinese products was removed on February last year and over 170 Indian steel companies including Jindal Stainless Ltd and Steel Authority of India have backed a petition to re-impose CVD for another five years, as per the DGTR report.