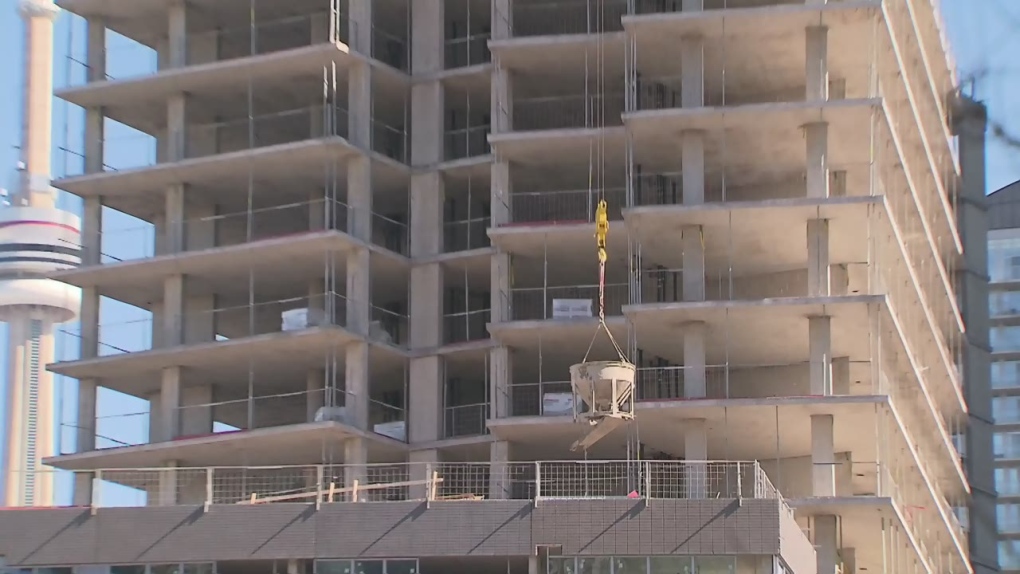

Free parking and mortgage holidays: Developers offering new incentives as Toronto preconstruction condo sales plummet

CTV

As preconstruction condo sales in Toronto plummet to levels not seen since the global financial crisis 15 years ago, developers are now turning to more lucrative incentives to try to entice prospective buyers.

As preconstruction condo sales in Toronto plummet to levels not seen since the global financial crisis 15 years ago, developers are now turning to more lucrative incentives to try to entice prospective buyers.

Last month, an Urbanation report found that there were only 1,461 preconstruction condo sales in the Greater Toronto and Hamilton Area (GTHA) so far this year, the lowest number of transactions recorded in the first quarter of the year since 2009, when just 884 sales were made.

According to the report, sales were down 71 per cent this year compared to average first quarter sales over the past 10 years.

Sales in the first quarter of 2024 also represent an 85 per cent drop from the first quarter of 2022, which saw 9,723 transactions, the report noted.

The sluggish sales activity has been attributed to high interest rates, which have resulted in higher construction costs and elevated borrowing costs. In some cases, high interest rates have prevented buyers from closing on previously purchased units as they no longer qualify for a loan.

The Urbanation report also found that since the market began slowing in 2022, 60 projects, amounting to 21,505 units, in the Toronto region that have been put on hold indefinitely.

“Most people don't know that a building cannot be built unless the developer sells at least 70 per cent (of the units),” Simeon Papailias, managing partner of Royal LePage's REC Canada, told CP24.com.