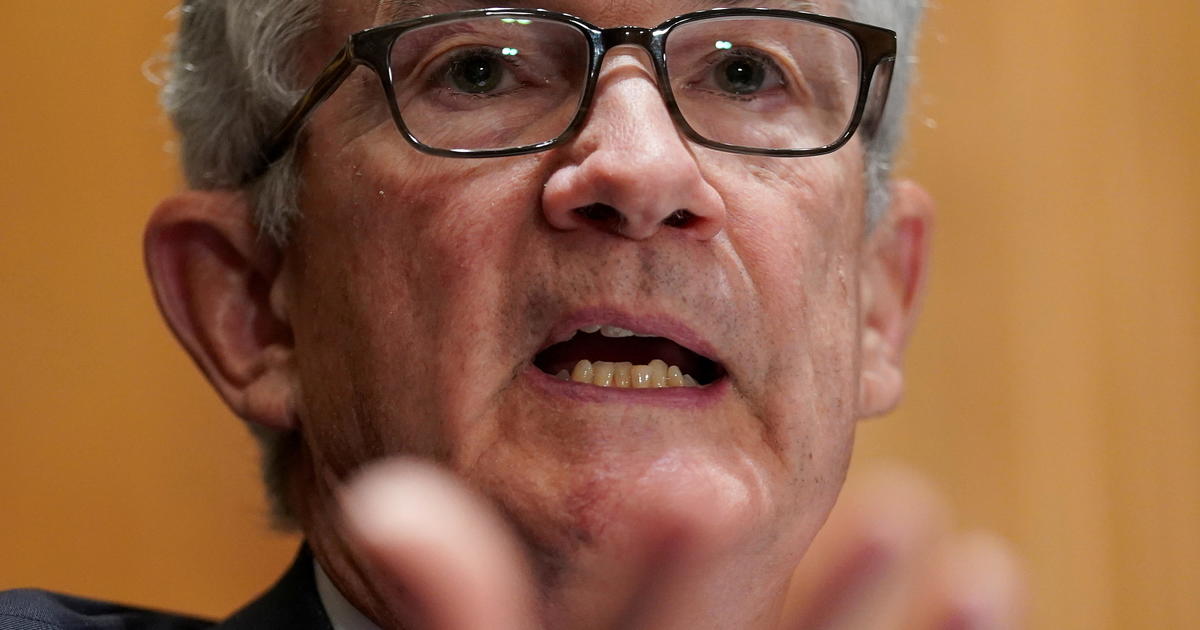

Fed on track to slow aid for economy later this year, Jerome Powell says

CBSN

Washington — The Federal Reserve will start dialing back its ultra-low-rate policies this year as long as hiring continues to improve, Chair Jerome Powell said Friday, signaling the beginning of the end of the Fed's extraordinary response to the pandemic recession.

The Fed's move could lead, over time, to somewhat higher borrowing costs for mortgages, credit cards and business loans. The Fed has been buying $120 billion a month in mortgage and Treasury bonds to try to hold down longer-term loan rates to spur borrowing and spending. Powell's comments indicate the Fed will likely announce a reduction — or "tapering" — of those purchases sometime in the final three months of this year. "Despite the resurgence in case loads, Powell is relatively upbeat about both the economic and inflation outlooks, and is eyeing the start of tapering this year, though perhaps later this year," Sal Guatieri, senior economist with BMO Economics, told investors in a report.More Related News