Despite a slow start, States’ capex likely to rise further this year

The Hindu

States' capital expenditure expected to rise despite initial drop, crucial for India's economic growth, according to rating agencies.

Capital expenditure by States, a key driver of India’s economic growth in recent times, may have started on the backfoot in 2024-25 with the general elections taking up the first quarter, and States’ capex dropping 7% from last year by August, but those spends may pick up steam in the coming months, rating agencies reckon.

This positive prognosis is significant as the Finance Ministry in a review of the economy late September had identified lower capex spends by States as one of the ‘incipient signs of strains in certain sectors”, along with other cooling signals for the economy like the drop in passenger vehicle sales in the first few months of the year.

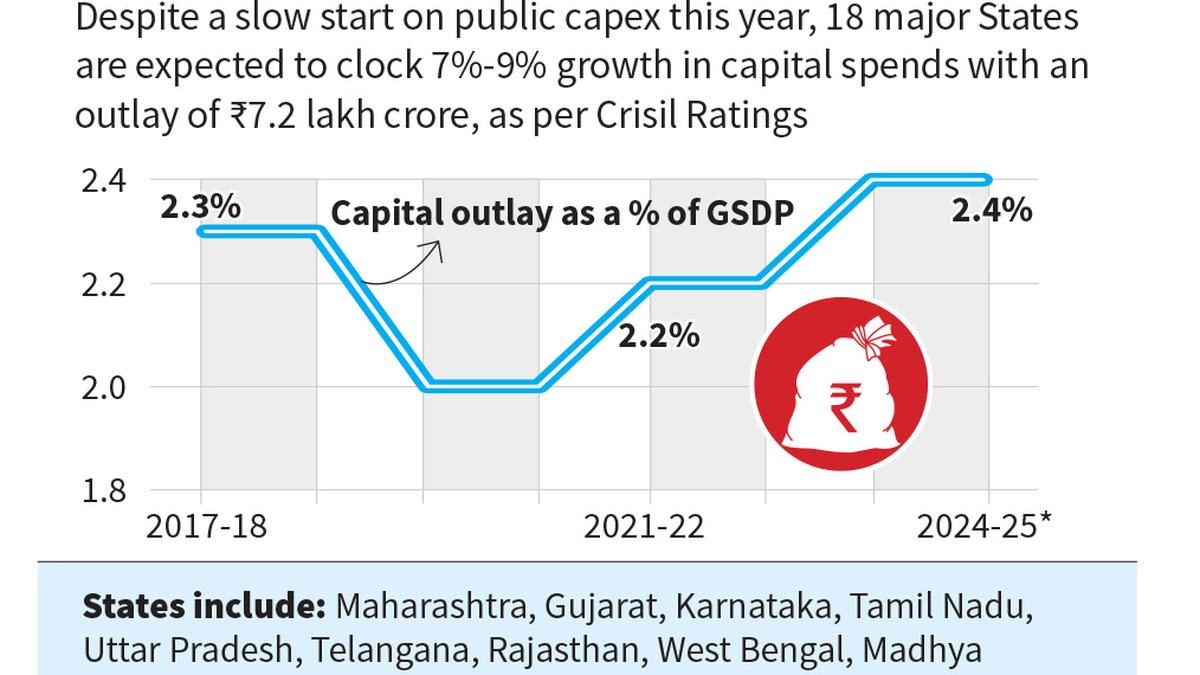

In a report on Tuesday, Crisil Ratings said it expects the capex outlays of India’s top 18 States that account for about 94% of the capital spending done by State governments, to rise in the range of 7% to 9% and hit ₹7.2 lakh crore, compared with ₹6.7 lakh crore in 2023-24.

Rating firm ICRA also recently said it expects the combined capital spending of 13 major States to rise 13% to ₹6.5 lakh crore this year, though that would be slightly lower than these States’ ₹7.2 lakh crore Budget estimate for capex.

ICRA economists attributed this to a dull start to capex in the initial months of 2024-25 and an anticipated undershooting in States’ revenues. However, of the 13 States they analysed, ICRA expects Gujarat, Karnataka, Maharashtra and Tamil Nadu to have enough fiscal space to meet their budgeted capex plans, said the firm’s chief economist Aditi Nayar.

CRISIL Ratings senior director Anuj Sethi expects a 7-9% growth in capital outlays, which translates to States achieving about 90% of their budgeted target this fiscal. “Though similar to last fiscal, it will be higher than the levels of 82%-84% achieved between FY2018 and FY2023,” he pointed out.

Mr. Sethi said their expectations of a pickup in the capital outlays for the remainder of this fiscal, were also backed by the evidence “from a step-up in States’ borrowings, which have already surged about 26% year-on-year in the second quarter [July to September] after a 15% year-on-year decline in the first quarter”.