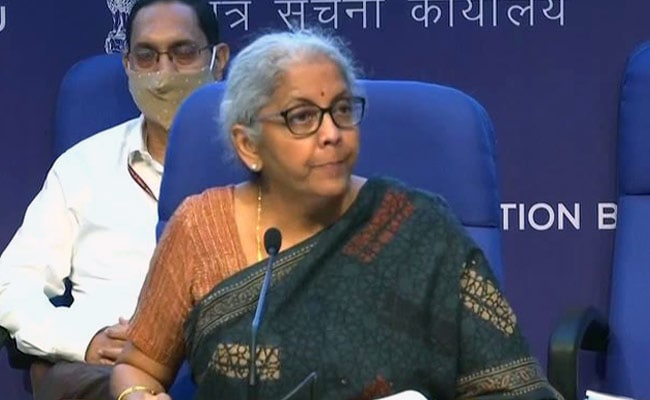

Centre Releases Draft Rules For Withdrawal of Retrospective Tax Demands

NDTV

The draft rules say the Centre will not proceed with demands related to retrospective tax levy, provided that all companies withdraw cases against it

Days after bringing in the Taxation Laws (Amendment) Act 2021 - which scraps the rule that empowered the government to retrospectively (going as far back as 50 years) impose capital gains tax on assets located in the country but whose ownership had changed abroad - the Centre has released draft rules for the legislation. The draft rules say that the government will not proceed with demands related to retrospective tax levy, provided that all companies with which such cases had been taken up, give an undertaking that they will withdraw all legal cases against it and will not pursue them in the future as well. With this development, all the retrospective tax demand cases with companies like Cairn Energy and Vodafone Plc, in which the Centre was involved, will come to a close. Under the retrospective tax rule, the government had levied around Rs one lakh crore from around 17 companies, including the ones mentioned above.More Related News