BMO customers out thousands of dollars unable to prove fraudulent e-transfers weren't their fault

CBC

Two Bank of Montreal customers in Toronto say they want the bank to implement better security measures and repay them the thousands of dollars they lost after e-transfers were mysteriously sent from their bank accounts using their own login information.

The online account of Lan Wang's elderly mother was accessed without authorization in November, and someone e-transferred $10,000 out of the account, according to bank documents reviewed by CBC News.

"It's all their savings. It's very tough for them," Wang said of his elderly parents. "They were relying on that money."

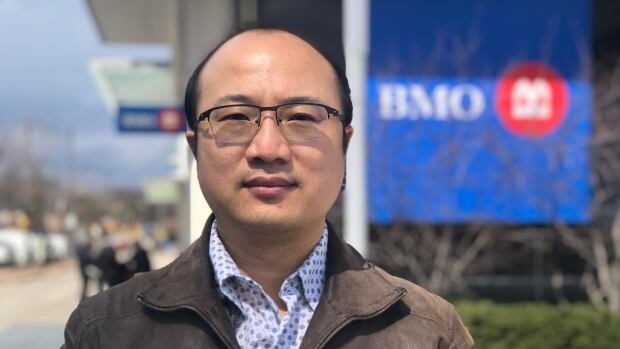

Just over a month later, someone took out cash advances on Jedy Huang's BMO credit card, transferred the money to his bank account, then e-transferred $7,400 out of the account, according to bank statements.

"This is a huge amount of money," Huang said. "It's [put a] very, very terrible burden on my family."

The two cases, which are among what experts say is a rising number of e-transfer fraud issues, illustrate how difficult it is for customers to prove that a breach wasn't their fault when their own login information and IP address are used to fraudulently access an online account.

While Wang and Huang aren't sure how the accounts were accessed, they say BMO could have done more to spot and alert them about the suspicious activity. The men, who want the bank to reverse the e-transfers, are sharing their experiences in an effort to warn others about the potential security risks of online banking.

"My mom trusted the Bank of Montreal. She put the money in [the bank] and it's shocking," said Wang, who is handling the issue for his mother due to her age and a language barrier.

In Huang's case, he's stuck with a credit card bill he can't pay, plus interest.

"I don't have that much money at this moment," he said. "I checked my credit scores and they went from very high to very low because I couldn't pay off the credit bill."

BMO didn't answer specific questions from CBC News, citing customer privacy, but in an emailed statement, a spokesperson said that "protecting customers' accounts and their personal information is our primary focus."

Wang filed a report with Canada's Ombudsman for Banking Services and Investments (OBSI). It says e-transfer complaints, especially relating to fraud, are a growing concern.

OBSI, which is funded by banks and investment firms, received 36 e-transfer complaints in 2021. The majority were related to fraud, which made up seven per cent of opened complaint cases that year. In the two years prior, e-transfer complaints represented just two per cent of opened cases, OBSI spokesperson Mark Wright said.

Wright said e-transfer complaints are typically difficult cases because it's hard to track down the fraudster.

Run 3 Space | Play Space Running Game

Run 3 Space | Play Space Running Game Traffic Jam 3D | Online Racing Game

Traffic Jam 3D | Online Racing Game Duck Hunt | Play Old Classic Game

Duck Hunt | Play Old Classic Game