BDA lost ₹3,500 crore by not collecting betterment tax: CAG

The Hindu

The Comptroller and Auditor General (CAG) found that the Bangalore Development Authority (BDA) lost ₹3,500 crore by not collecting betterment tax, and criticised the body for its “lackadaisical effort” and “poor financial management”. CAG report on Department and Public Sector Undertakings for the year ended March 22.

The Comptroller and Auditor General (CAG) found that the Bangalore Development Authority (BDA) lost ₹3,500 crore by not collecting betterment tax, and criticised the body for its “lackadaisical effort” and “poor financial management”.

The CAG report on ‘Department and Public Sector Undertakings for the year ended March 22’, which was tabled in the Legislative Assembly on Thursday, said the BDA could collect only ₹3.22 crore out of ₹3,503.63 crore betterment tax, despite having legal authority and necessary approval from the government, the CAG said.

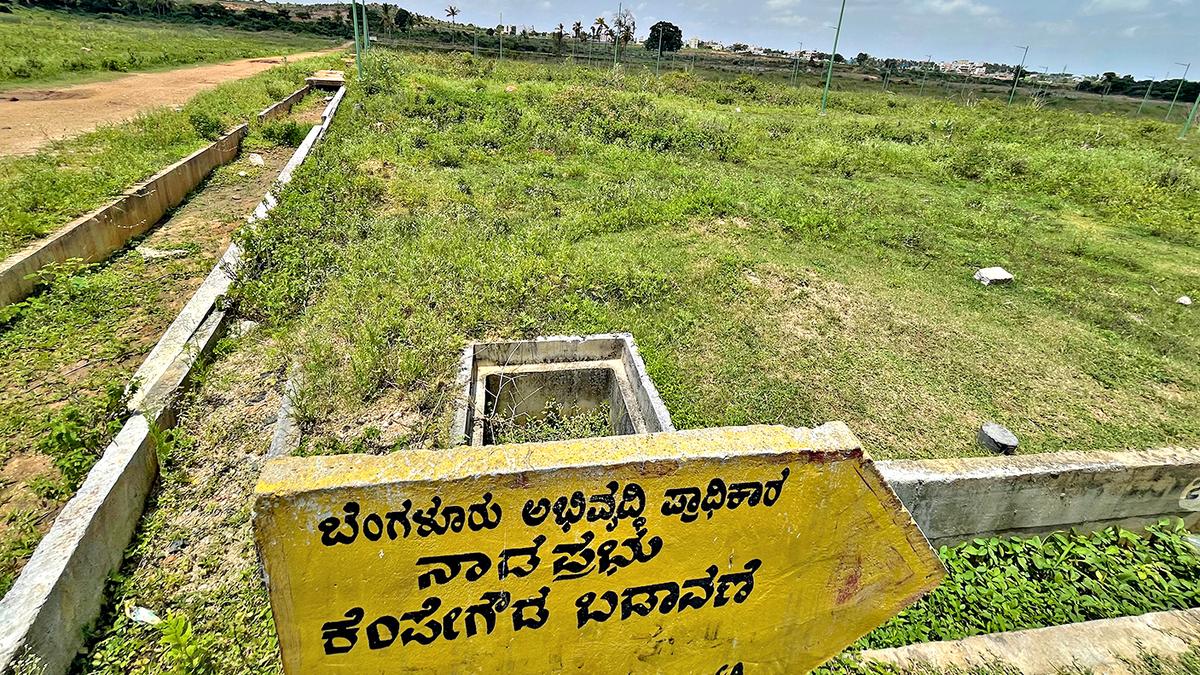

It said that the BDA could have collected the betterment tax of ₹3,307.91 crore at the Arkavathy Layout and ₹195.72 crore from the Nadaprabhu Kempegowda Layout (NPKL).

The BDA had identified 2,262.15 acres from 1,699 landowners at the rate of ₹3.65 lakh per gunta for betterment tax at the Arkavathy Layout. At NPKL, 610.02 acres belonging to 315 landowners at the rate of ₹80,208 per gunta were identified. The government approved levy of betterment tax in February 2018.

In 2019 and 2020, the authority ended up paying ₹34.66 crore interest for the outstanding loans, which was “avoidable had the BDA made earnest efforts to realise potential revenue sources such as betterment tax”, the audit said.

The CAG noted irregularities in the allotment of sites under the BDA’s incentive scheme, leading to “undue benefits” of ₹10.54 crore to landowners.

The CAG noted a glaring disparity in the allocation of funds to temples and said that between 2017-18 and 2021-22, Muzrai temples received ₹44.48 crore as against ₹187.81 crore given to private temples.