Bank of Canada worries supply chain disruptions could persist

BNN Bloomberg

The Bank of Canada is worried that global supply chain disruptions stoking inflation could last longer than expected, according to a top official.

The Bank of Canada is worried that global supply chain disruptions stoking inflation could last longer than expected, according to a top official.

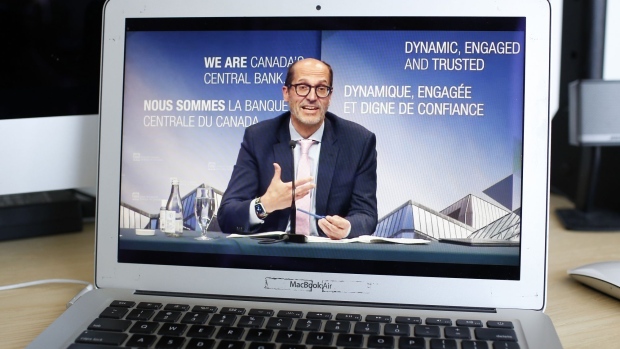

In a speech a day after policy makers left interest rates unchanged, Deputy Governor Toni Gravelle said Thursday the duration of supply disruptions “figured prominently’ in deliberations ahead of the decision.

While reiterating that officials expect these constraints to eventually ease along with inflation next year, Gravelle emphasized there’s a lot of uncertainty around that outlook. In January, the central bank will reassess whether bottlenecks and shortages are impacting the economy’s ability to grow without fueling inflation.

The comments are likely to reinforce expectations the Bank of Canada is considering raising interest rates soon, given inflation has surged well above its 2 per cent target. They also suggest it could scale back further -- as early as next month -- its estimate of the nation’s productive capacity. A similar forecasting adjustment in October allowed the central bank to accelerate the the potential timing of rate increases.

“Our current view remains that we should see elevated inflation subside in the second half of next year,” Gravelle said in prepared remarks for a speech aimed at providing more insight into Wednesday’s decision. “However, we will conduct a full assessment of this risk in January when we update our projection for the economy and inflation.”

The Bank of Canada has pledged not to raise interest rates before the economy is fully recovered and has absorbed all remaining slack. In October’s economic projections, it forecast this would not happen before April. Markets are anticipating the central bank will raise interest rates five times next year.