Advent International to invest ₹2,475 cr. in Apollo HealthCo

The Hindu

Apollo HealthCo Ltd. partners with Advent International to raise ₹2,475 crore, merge with Keimed, creating a leading retail health company.

Apollo HealthCo Ltd. (Apollo 24/7) has entered into a binding agreement with a global private equity investor Advent International (Advent) to raise an equity capital of ₹2,475 crore.

In addition, Apollo 24/7 has entered into a framework agreement to integrate 100% of Keimed Pvt. Ltd. (Keimed), promoted by the Apollo promoter group, in a phased manner over the next 24-30 months, the subsidiary of Apollo Hospitals Enterprise Ltd. said in a statement.

Advent would invest in compulsory convertible instruments over two tranches to secure 12.1% stake in the merged entity at an enterprise value of ₹22,481 crore.

Apollo 24/7 is valued at an enterprise value of ₹14,478 crore and Keimed at ₹8,003 crore. Pursuant to the merger, Keimed shareholders would hold a maximum of 25.7% stake in the combined entity, while AHEL would continue to remain the largest controlling shareholder with at least 59.2% stake. The merger is subject to further corporate approvals. The merger with Keimed is estimated to be earnings per share accretive from year one.

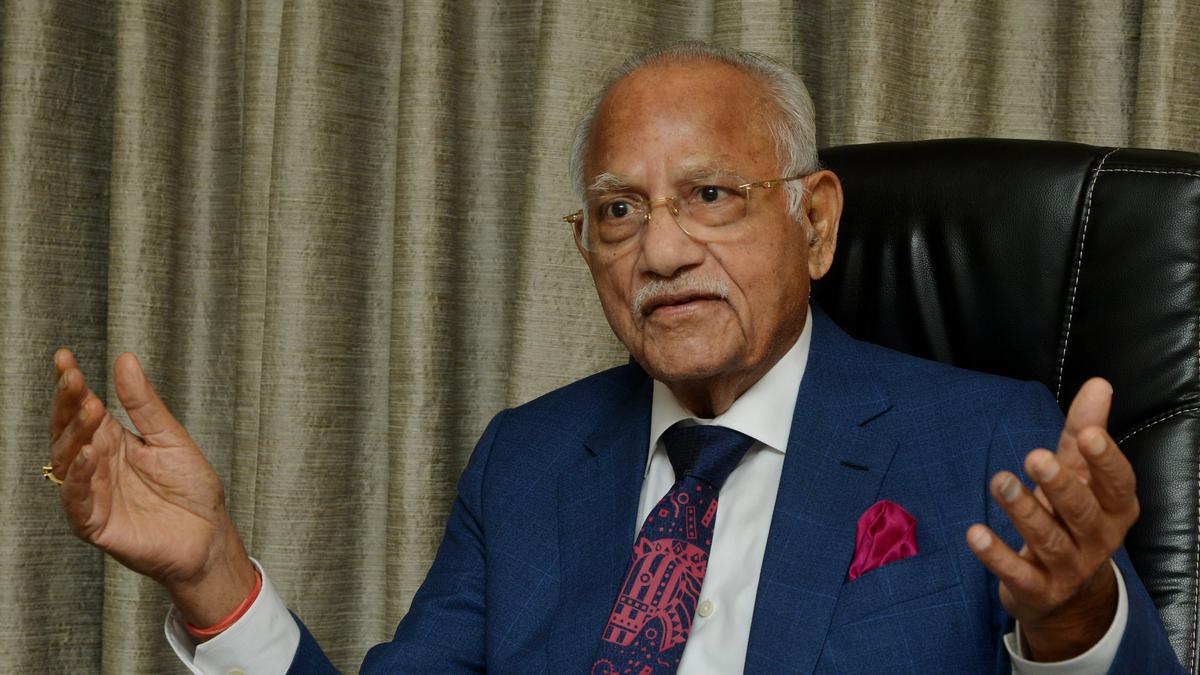

“With Advent’s investment and the merger of Keimed, the combined entity will be one of the country’s leading retail health companies,” said Apollo Hospitals Group Chairman Prathap C. Reddy.

The rationale behind the deal is to create India’s leading integrated pharmacy distribution business, complemented by the fast growing omni-channel digital health business.