Aditya Birla Sun Life plans to double its business by FY-27

The Hindu

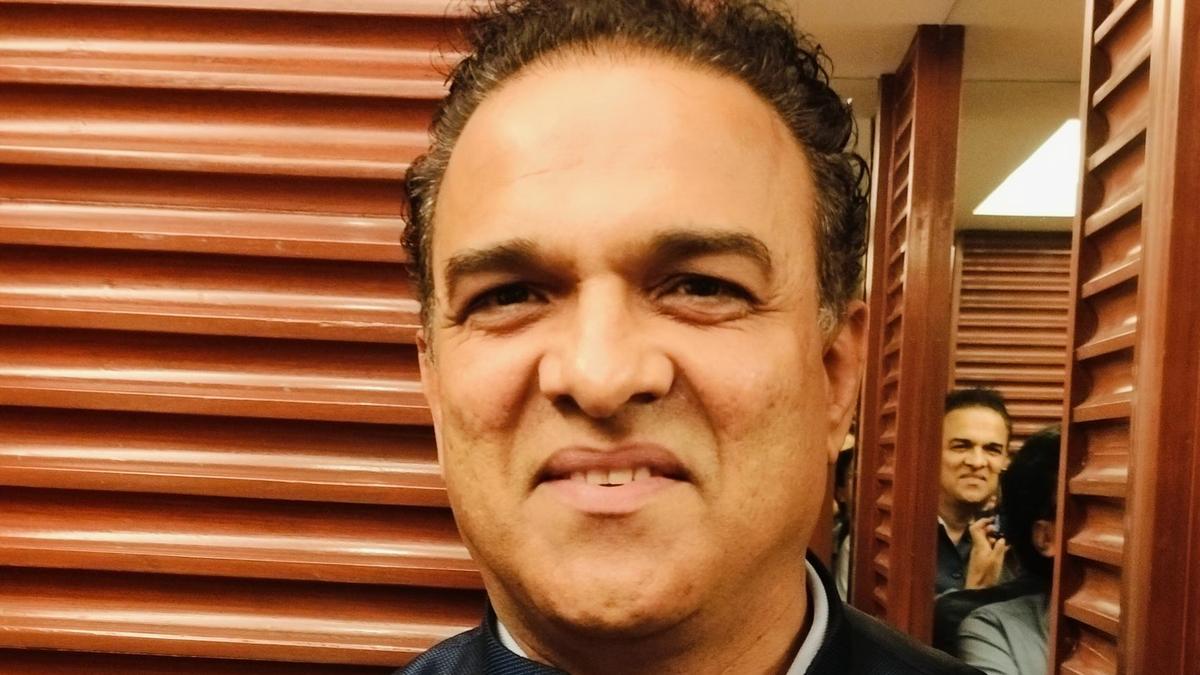

Aditya Birla Sun Life Insurance Co. Ltd. has drawn up a multi-pronged strategy to double its business over the next three years using unconventional route and innovative products, said its MD & CEO Kamlesh Rao

Aditya Birla Sun Life Insurance Co. Ltd., (ABSLI) has drawn up a multi-pronged strategy to double its business over the next three years using unconventional route and innovative products, said its MD & CEO Kamlesh Rao.

“We have drawn up plans to double our revenues from all streams by FY27 using unconventional route and innovative products,” he said in an interaction.

The plan calls for doubling the individual first year premium from ₹3,000 crore to ₹6,000 crore, group life insurance from ₹4,000 crore to ₹8,000 crore, value of new business margin from ₹700 crore to ₹1,350 crore and gross written premium from ₹17,500 crore to ₹35,000 crore.

According to him, ABSLI plans to achieve this target by focusing on new products, enhancing distribution channels, doubling manpower and creating new distribution agencies.

Talking about the unconventional route, he said: “Our initial focus is on two wheeler, four wheeler and commercial vehicles dealers, chemist, jewellers, travel agents and holiday partners, who are having a huge loyal customer base. At the dealerships, we have vehicle insurance agents, who have not sold life insurance in the past. We are targeting them.”

ABSLI also did a pilot run with 65 partners in a tier-III town in Uttar Pradesh. Though, it tasted some success with car and two wheeler dealers, it was not so encouraging with chemists and jewellers. It is likely to try its hand with travel agents and resort owners soon.

“While some came forward to deploy their own staff for the new services, others sought our help in training. We will be looking at more agencies. In the first year, we expect to do a business of ₹150 crore,” he said.