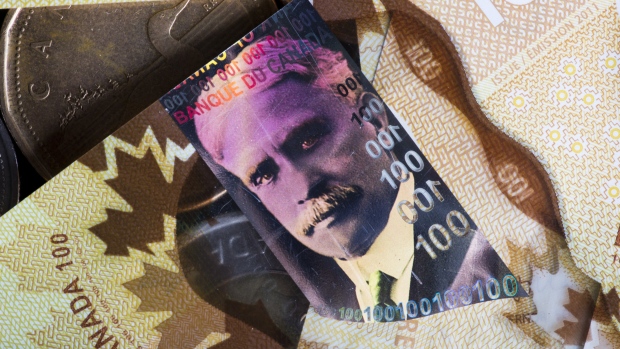

27% of Canadians cutting back on necessities amid inflation: MNP

BNN Bloomberg

Some Canadians are scaling back spending on basic life necessities such as food, utilities and housing as the cost of living continues to surge, the latest MNP Consumer Debt Index survey has revealed.

Twenty-seven per cent of respondents said they’ve cut back on essentials, while 37 per cent said they've chosen to buy cheaper versions of their everyday purchases, the data showed. Nearly half (46 per cent) have cut back on non-essential items, including travelling, dining out and entertainment.

Six in ten reported they were already feeling the impact of higher interest rates – a seven-point jump in the index compared to last quarter. The survey was conducted by Ipsos on behalf of MNP LTD.

“No matter where Canadians turn, there is no reprieve; housing is more expensive, driving a car is more expensive, food is more expensive,” Grant Bazian, president of MNP, a large debt consulting agency in Canada, said in a press release on Monday.