Tax hike on wealthy donors could add to charity woes in 2024

BNN Bloomberg

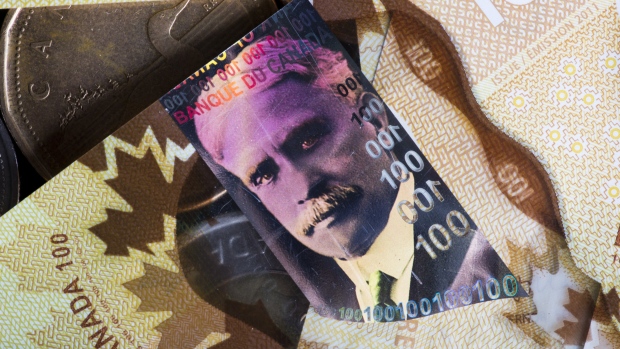

At a time when Canadian charities are having to do more with less, the federal government is set to impose a tax hike that could put a serious damper on donations.

Starting in 2024, the alternative minimum tax (AMT) flat rate on charitable donations will increase to 20.5 per cent from 15 per cent. The AMT aims to prevent wealthy donors from paying little or no tax by claiming certain deductions relating to capital gains and dividend tax credits.

Kim Moody, founder of Calgary-based Moodys Tax Law, says the increase will have the unintended consequence of discouraging donations to Canadian charities.

“There is no doubt that the charitable sector has cause for concern, since it would often make little sense for high-income earners to make charitable donations,” he says.